We exist to make our customers happy

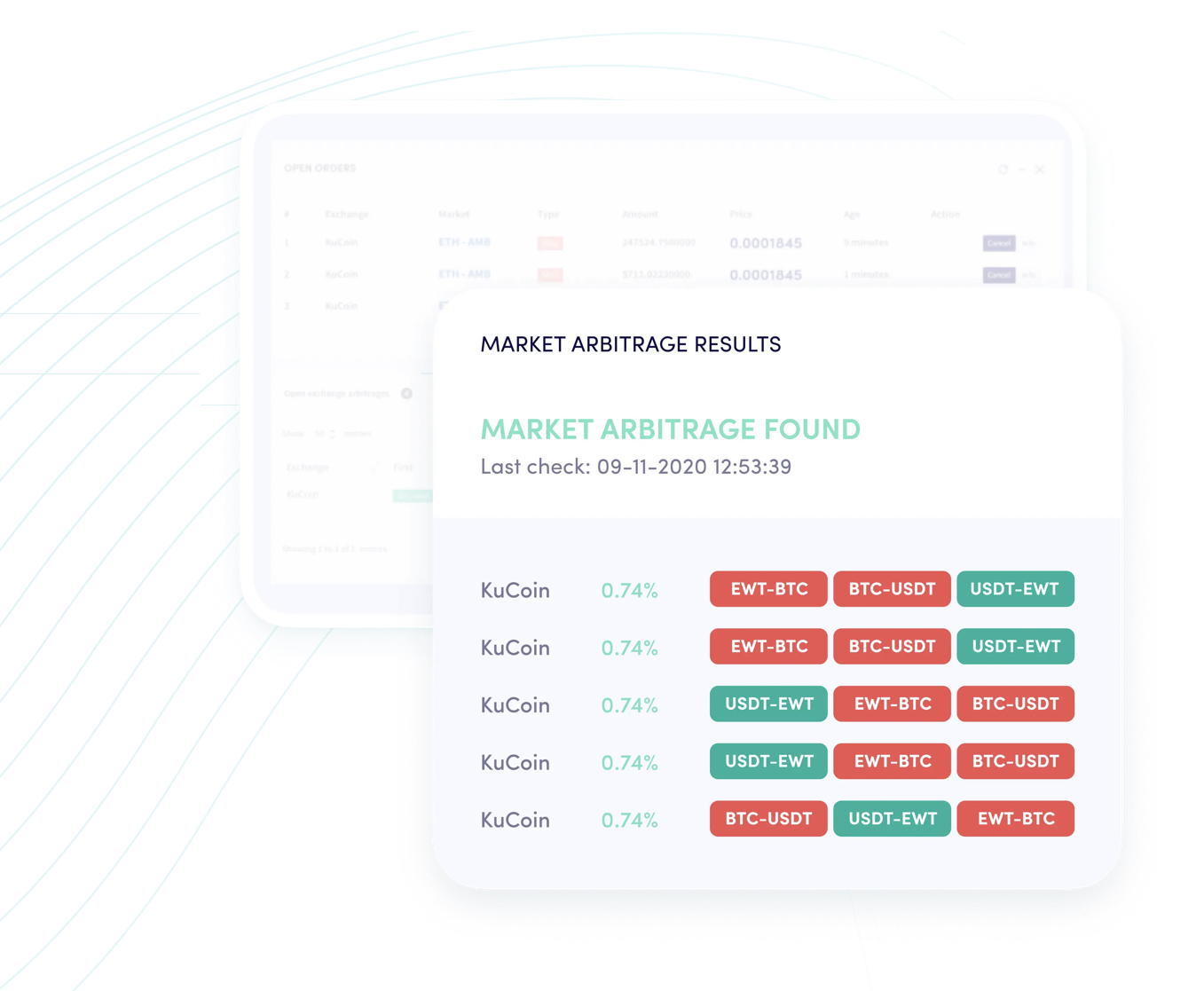

The Market Maker bot provides liquidity to a market of your choice and can alternatively act as a way to profit from a big spread. The spread is the difference between the highest bid and the lowest

ask. The highest bid is the highest someone is willing to offer, while the lowest ask is the lowest price someone is willing to sell his assets for. Illiquid markets have big spreads, and market makers are the ones that place orders around to spread profit from it, reduce the spread, and therefore create liquidity.

API

Master users of Itrust’s Loyalty program can built their own trading features on top of the existing features by using Itrust’s API. This is a feature for power users that like to like to code their own trade ideas.