Smart stock Investing

Invest in individual stocks. Skip the endless hours of research to find companies not on your radar and see stocks in a whole new light — with fractional shares and no commissions

Get StartedFind stocks you know and stocks you don't...

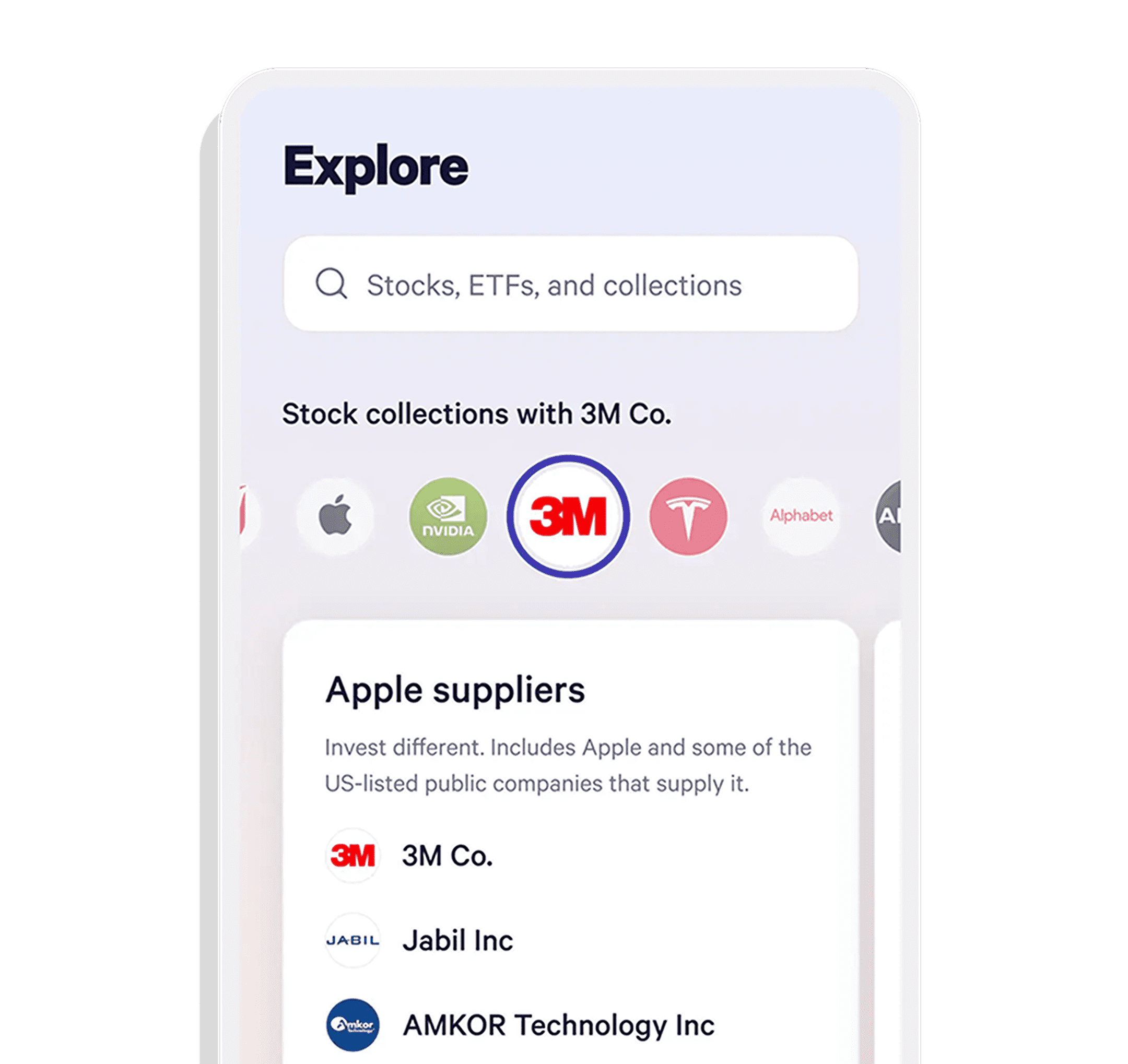

Discover stocks through investing themes & opportunities

See our latest perspectives...

Dive in with our built-in data

An excellent tool

For finding great stocks

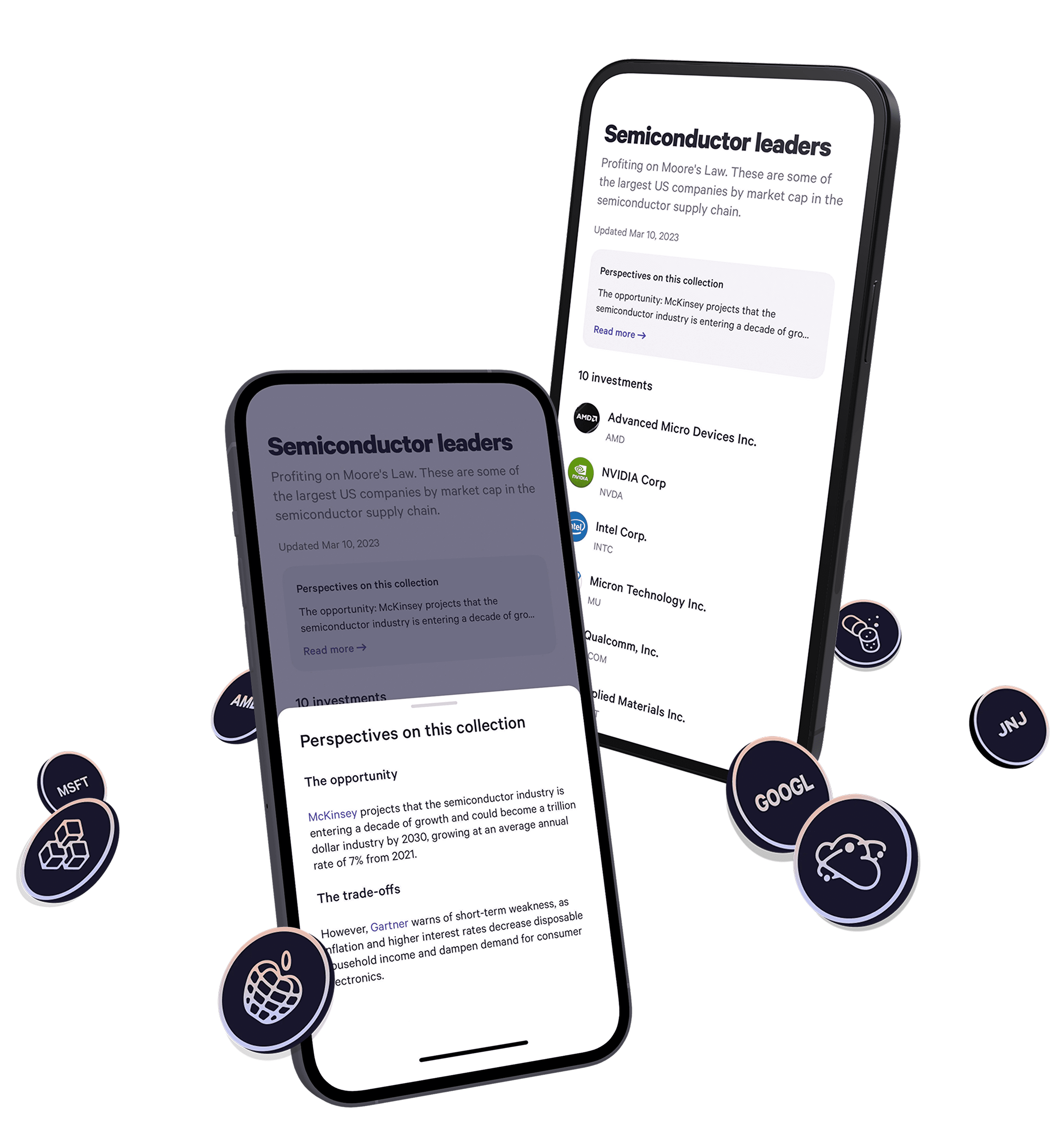

Our stock collections are designed around investing themes and opportunities to help you make smarter investing decisions, faster. Choose one or multiple stocks from dozens of pre-built collections. Or get started by picking the stocks you already know and love.

19 stocks

Subscription Model

Companies that sell products or services under a subscription model.

14 stocks

Buybacks

Profitable companies (return on equity of at least 20% in the past two years) that have undertaken significant buybacks (shares outstanding decreased by at least 10%).

20 stocks

Transformative Hardware Tech

Leading innovative hardware/production companies using or developing fast-growing technologies.

11 stocks

Wide Moats

The 11 largest companies by market cap that have strong competitive advantage over competitors and over 20% of industry sales.

10 stocks

Semiconductor Leaders

These are 10 of the largest US companies by market cap in the semiconductor supply chain.

15 stocks

Transformative Software Tech

Leading innovative software/service companies using or developing fast-growing technologies.

9 stocks

Dividend Blue Chip Stocks

It can pay to buy shares. These Dow 30 companies have a dividend yield of at least 3.00%.

8 stocks

Cloud computing

These companies provide cloud computing infrastructure, the collection of hardware and software elements needed to enable cloud computing.

15 stocks

Lower volatility, lower risk

These stocks have the lowest expected volatility, according to Wealthfront’s risk model.

6 stocks

Streaming

Invest in some of the most popular streaming services and hardware producers in the US.

15 stocks

Rising interest rates

Earn on other’s interest. These are some of the largest banks, brokerages, and insurers listed in the U.S.

See more stocks

Beyond the obvious

Companies you know you know

Companies you don’t know you know

Companies you know you don’t know

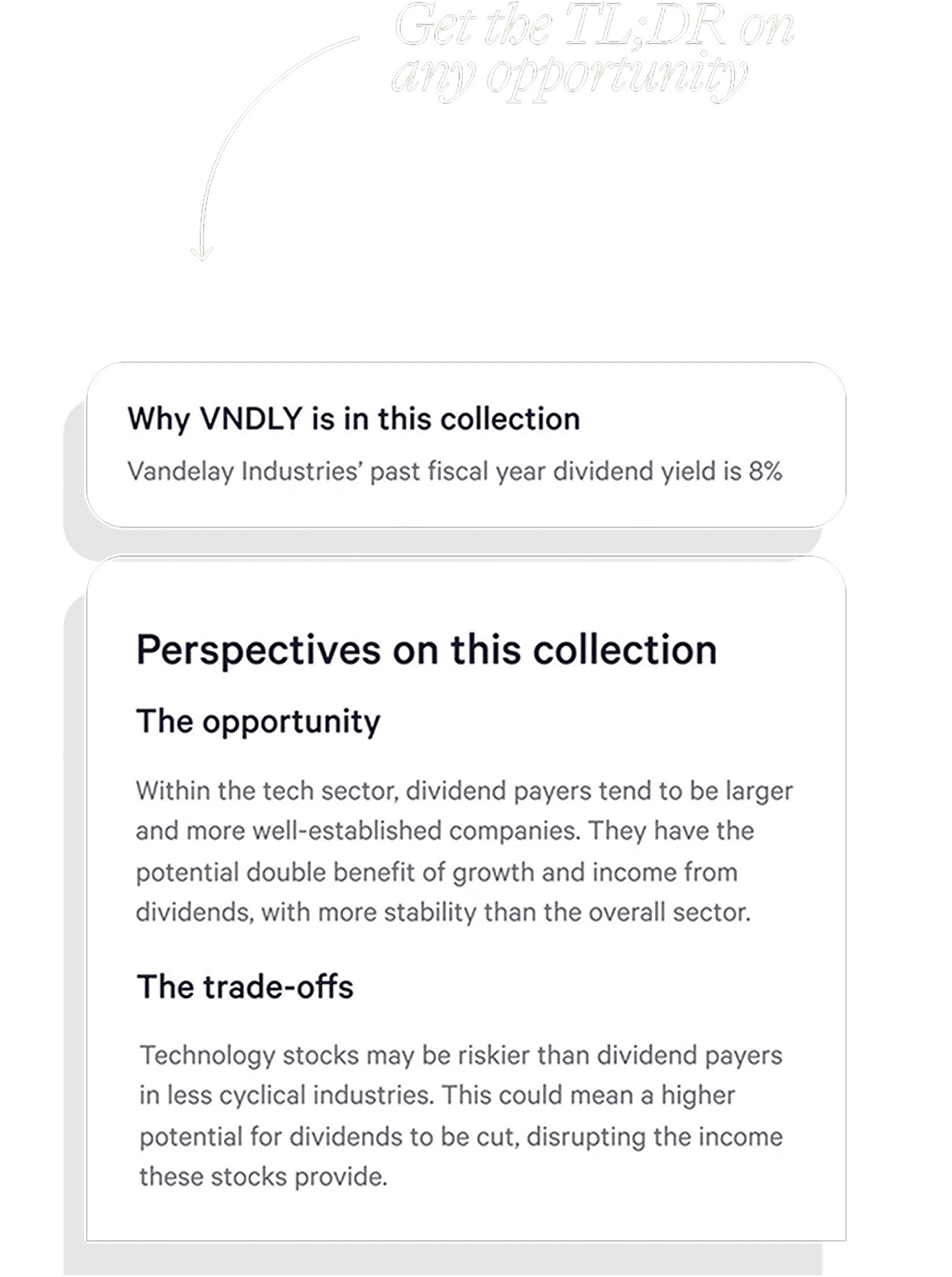

Due Diligence

Done for You

1,500+ stocks selected by our research team

Learn more about each stock in a collection

Spend less time micromanaging your investments

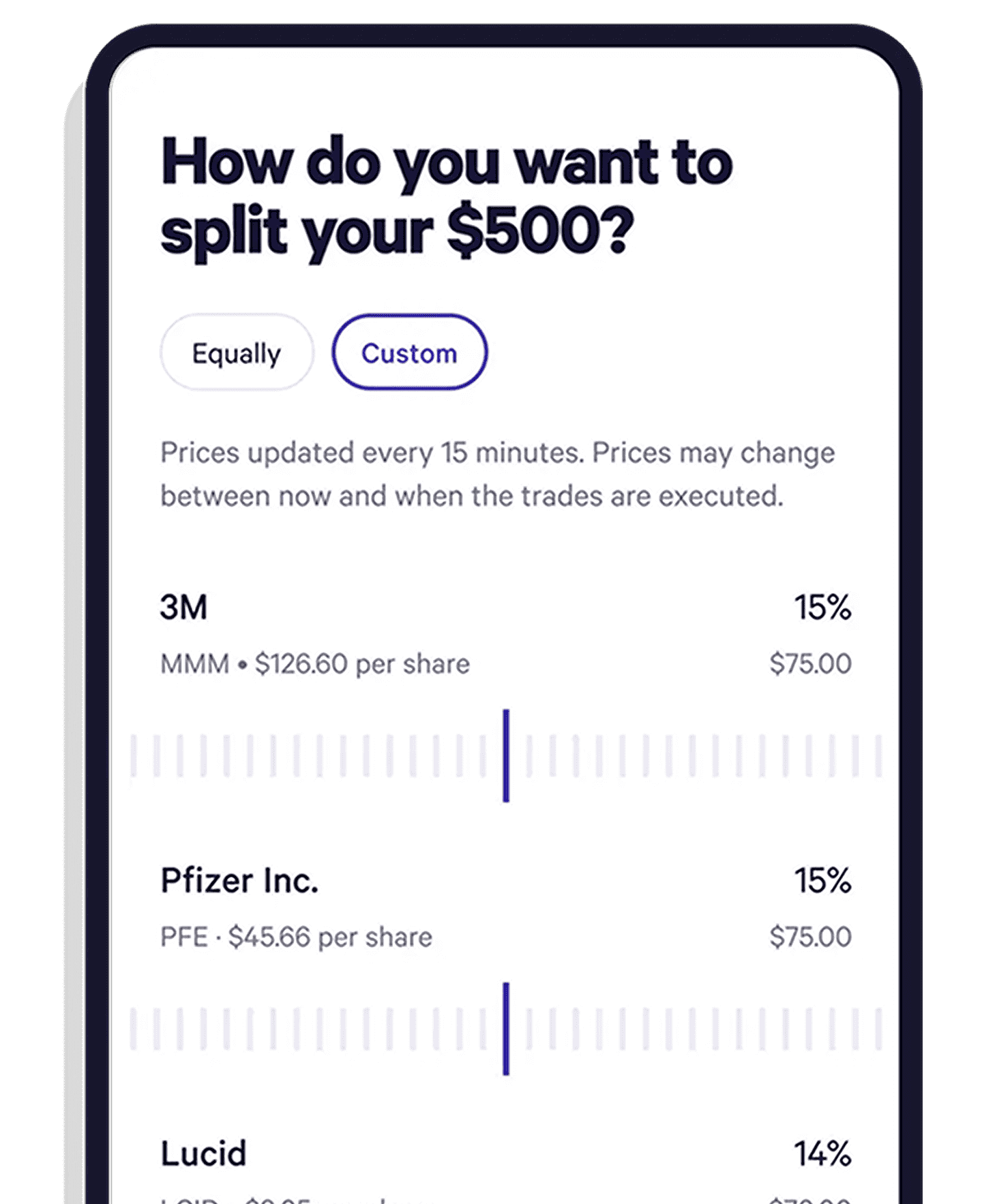

Make one deposit,

Buy multiple stocks

Invest

In multiple stocks more easily

Decide how much to invest,

and we'll split your deposit into multiple stocks and

Companies you don’t know you know

Companies you know you don’t know

Not sold on individual stocks?

Diversify your portfolio with the Automated Investing Account.

Grow your long-term wealth with a portfolio of diversified, low-cost index funds. We’ll handle all the investment decisions, rebalancing, and other busy work for the low, annual fee of just 0.25%. And that’s almost nothing considering our automated Tax-Loss Harvesting covered our fee more than 6x over, on average.

Earn 4.50% APY with the Cash Account.

Pay bills, save money, or invest in minutes during market hours. Our technology lets you automate your paycheck and organize cash effortlessly, while earning 9x the average national interest rate.

Takeaway

Stock markets are complex, but they’re all based upon one simple concept... From New York to Hong Kong, every stock market helps connect buyers and sellers, who trade under an agreed upon set of rules.

Get Started