What should you do with your money?

We have the accounts that make it easy to decide. From growing your savings to building long-term wealth, you can be invested with your preferred balance of risk and return.

Get StartedEarn more on your extra cash with zero state taxes.

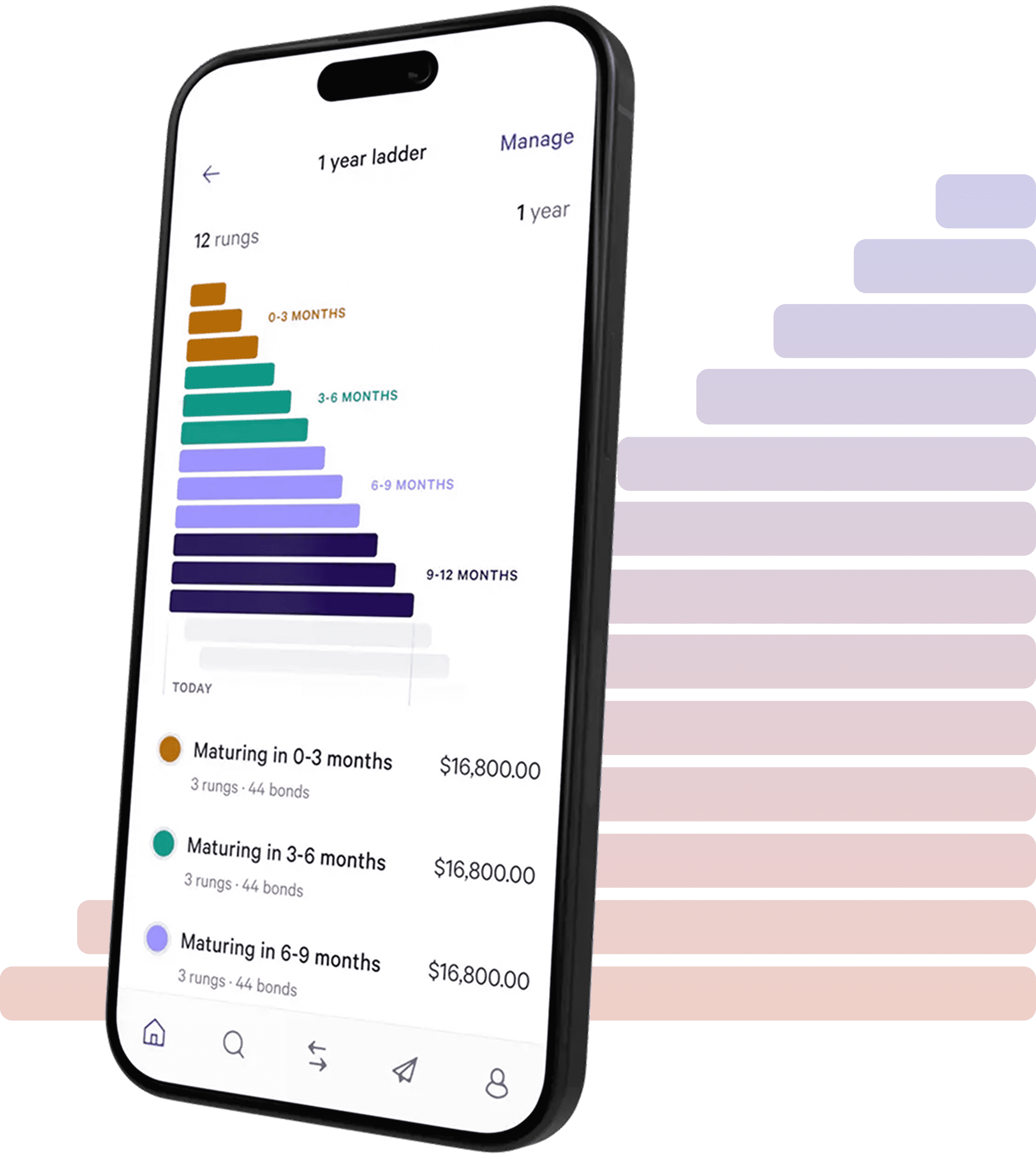

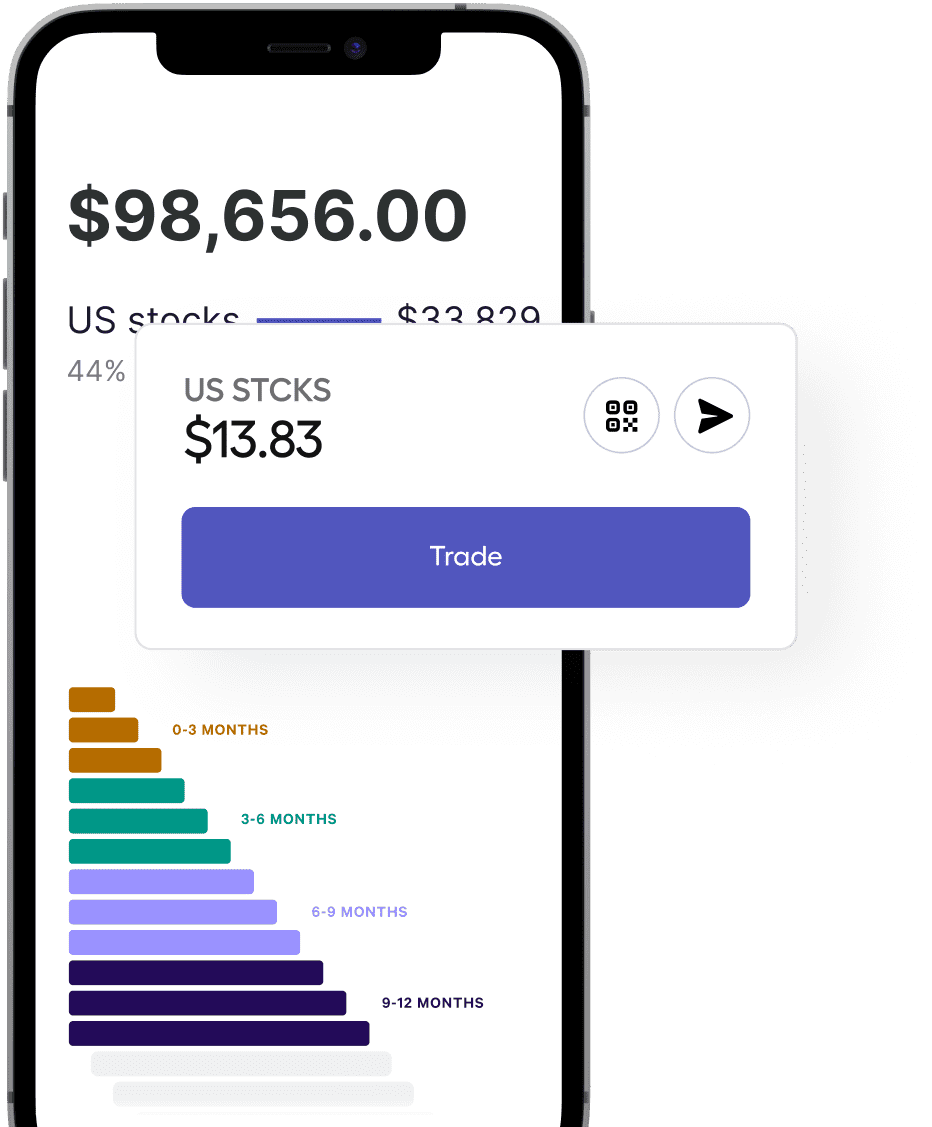

A ladder of US Treasuries can help you earn more — and keep more — than most savings accounts and some CDs. Since Treasuries are exempt from state and local income taxes, you can take home more interest on money you may be saving for future expenses. Just choose how long you want to invest, when you want your funds back — and we’ll handle the rest.

Using a ladder of Treasuries, maintain a high yield. (And avoid paying state income taxes.)

Safety, security and compliance. Adapting to legal verification and complying with federal regulations guarantees the lifetime safety of your assets and funds.

Keep your savings up.

Even if interest rates drop.

Although the federal funds rate is expected to decline* regularly over the next two years, you can still lock in current rates by investing in a ladder of Treasuries today. By holding multiple Treasuries of different maturities, you’ll earn a steady yield for your chosen duration.

To build your own bond ladder, you’ll need patience and plenty of research.

Or just use our service.

Choose how long you want to invest (from three months to six years) and we’ll show you your estimated average yield. We’ll compare hundreds of Treasuries to prioritize high coupon payments and liquidity, and keep your ladder balanced as your rungs mature.

A good investment starts with asking good questions.

Don’t save your

questions.

We’ve got answers.

1. What exactly is a bond ladder?

We’re glad you asked! (And everyone does.) A bond ladder is a portfolio of bonds with varying maturities, designed to minimize your exposure to interest rate fluctuations — in any rate environment. Bond ladders include monthly “rungs,” like steps in the ladder. Each rung represents one or more bonds that mature over time at certain intervals. As those bonds, or rungs, mature, you’ll get your principal back, which can then be reinvested into existing or new rungs.

Thus, a bond ladder can offer predictable cash flow through interest payments and maturing principal, with reduced interest rate risk compared to buying one individual bond. In other words, it can be a great way to earn a steady yield — and preserve your principal — over a long period of time.

2. So, how does your Automated Bond Ladder work?

We’ll keep it simple: The Automated Bond Ladder is composed entirely of US Treasuries (a mix of bills and notes), which offer principal protection as long as the Treasuries are held to maturity. Our Automated Bond Ladder can help you take home a higher yield than holding funds in cash, while safeguarding your principal. We’ll compare hundreds of Treasuries to prioritize high coupon payments and liquidity, and keep your ladder balanced as they mature.

3. No state income taxes? For Treasuries? Really!?

Really, really. The interest you earn from Treasuries is exempt from state and local income taxes. That means, if you live in a state with state income taxes, you can keep more of the interest you earn. Looking at you, California.

4. Is there any fee for withdrawing my money early?

No. Unlike a CD, you can easily withdraw your money at any time. However, in order to earn the full yield from your bond ladder, you’ll need to hold it to maturity. If you sell a Treasury before it reaches maturity, you could lose some of your principal.

5. How is the Automated Bond Ladder different from the Automated Bond Portfolio?

The big difference between the Automated Bond Ladder and the Automated Bond Portfolio: the two involve different types of portfolio investments and different risk profiles

The Automated Bond Ladder focuses on preserving your money while earning interest by investing in Treasuries. A ladder of US Treasuries that mature at different times gives you predictable cash flow over the length of your ladder. Compared to our Automated Bond Portfolio, it’s designed to protect your principal as long as you’re able to hold the Treasuries until maturity. However, if you sell your Treasuries before maturity you may have lower returns than the Automated Bond Portfolio.

The Automated Bond Portfolio, on the other hand, aims for higher returns but comes with more risk since it consists of bond ETFs that include corporates. Compared to our Automated Bond Ladder, most bond ETFs do not hold bonds to maturity and hence are not aimed to preserve principal. However, if you’re okay with a little more risk, there’s the potential to earn more, too.

6. How do I know if this product is right for me?

The Automated Bond Ladder is designed for investors who want to earn a steady yield with very little risk. A ladder can be a great way to save for important expenses down the road, like a down payment, a child’s tuition or a soonish retirement. If you’re OK with more risk for potentially higher returns, then the Automated Bond Portfolio might be a better fit.