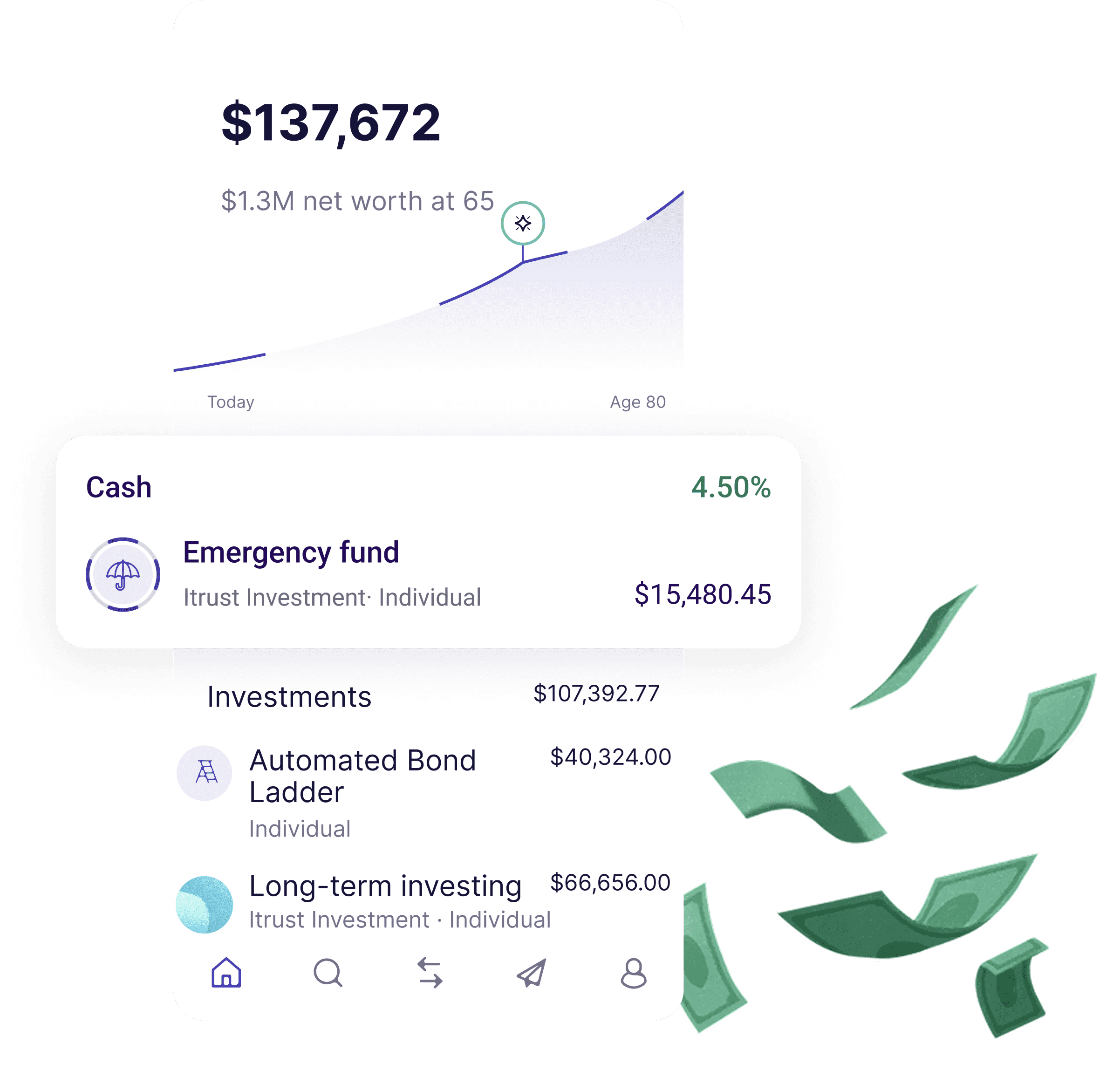

Earn 4.5% APY on your cash

right until you need it.

Earn an industry-leading APY through partner banks with free same day. Everyday withdrawals

Zero account fees

No minimum or maximum balance to earn 4.50% APY

Up to $8M in FDIC insurance

Optimize your cash today.

Start saving for tomorrow.

Set money aside for what matters to you. Create multiple savings goals and use our automated tools to help you achieve them.

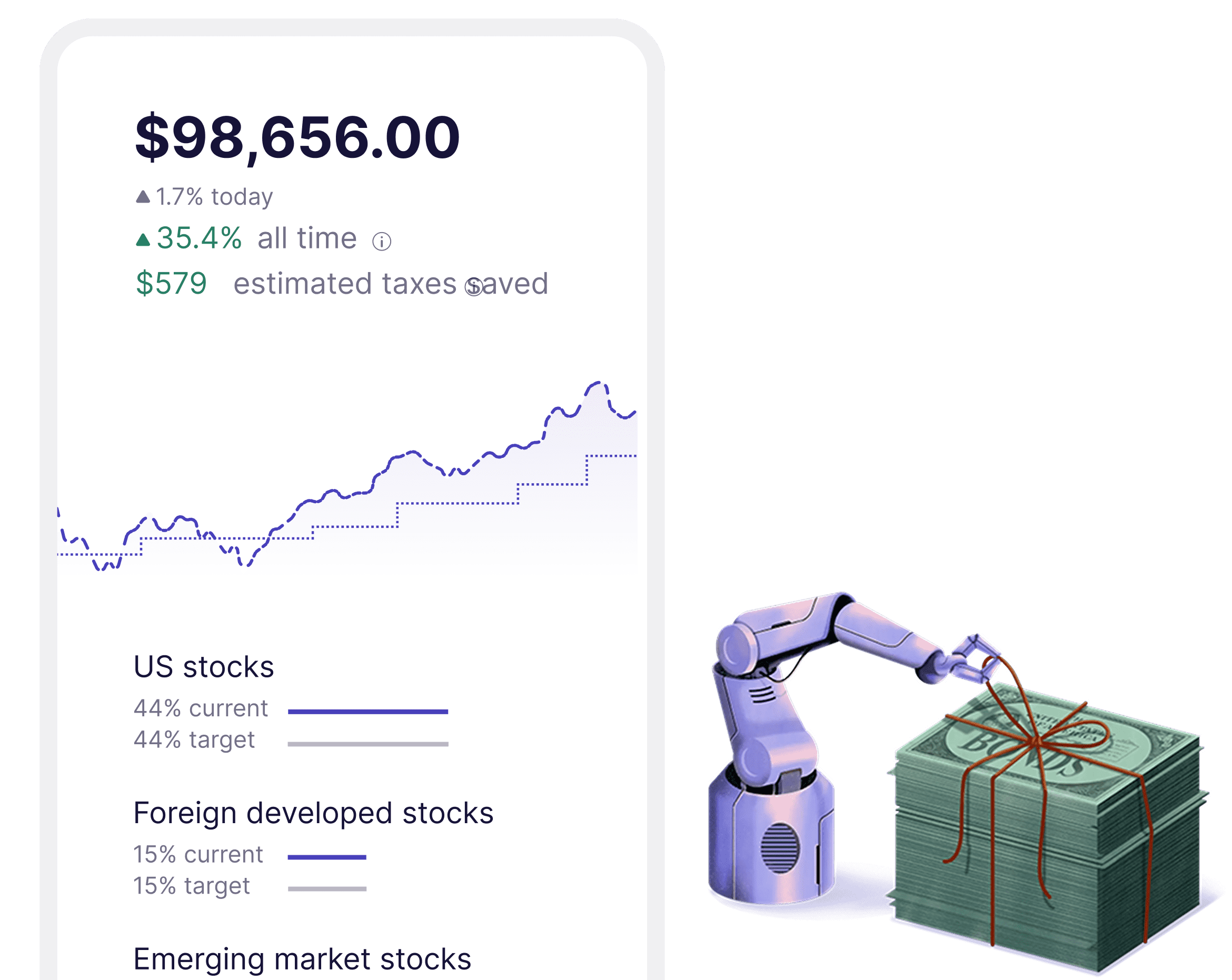

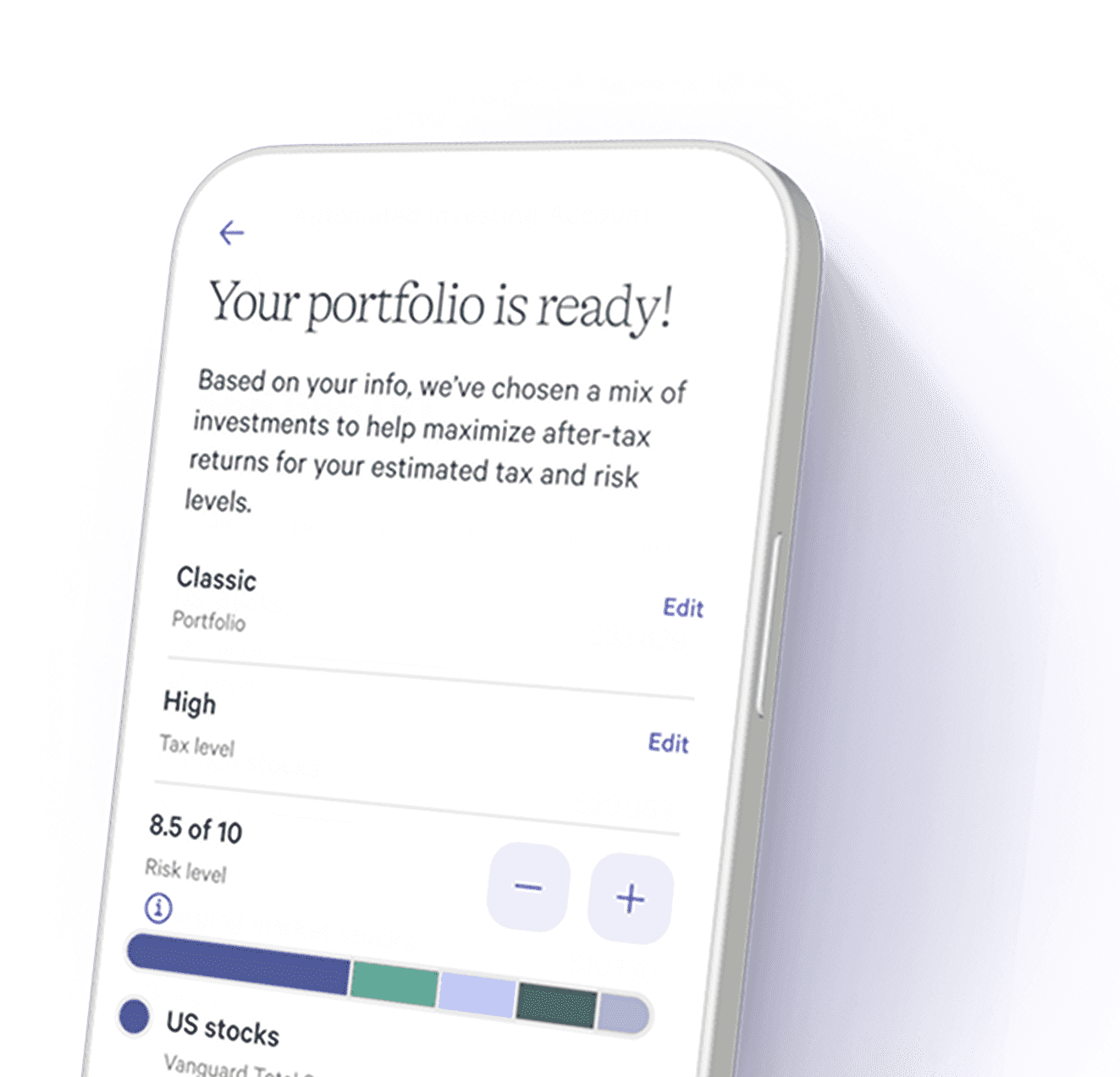

Automated Diversified Index

Cash Reserve lets you earn interest even during volatile times. FDIC insurance covers your money up to $2 million ($4 million for joint accounts) at our program banks, meaning you won’t have to sacrifice security for growth.

Cash Features

ATM fee reimbursement

We’ll reimburse 2 fees per month at out- of-network ATMs globally. (up to $7.50 each). You can also access 29,000+ free ATMs nationwide.

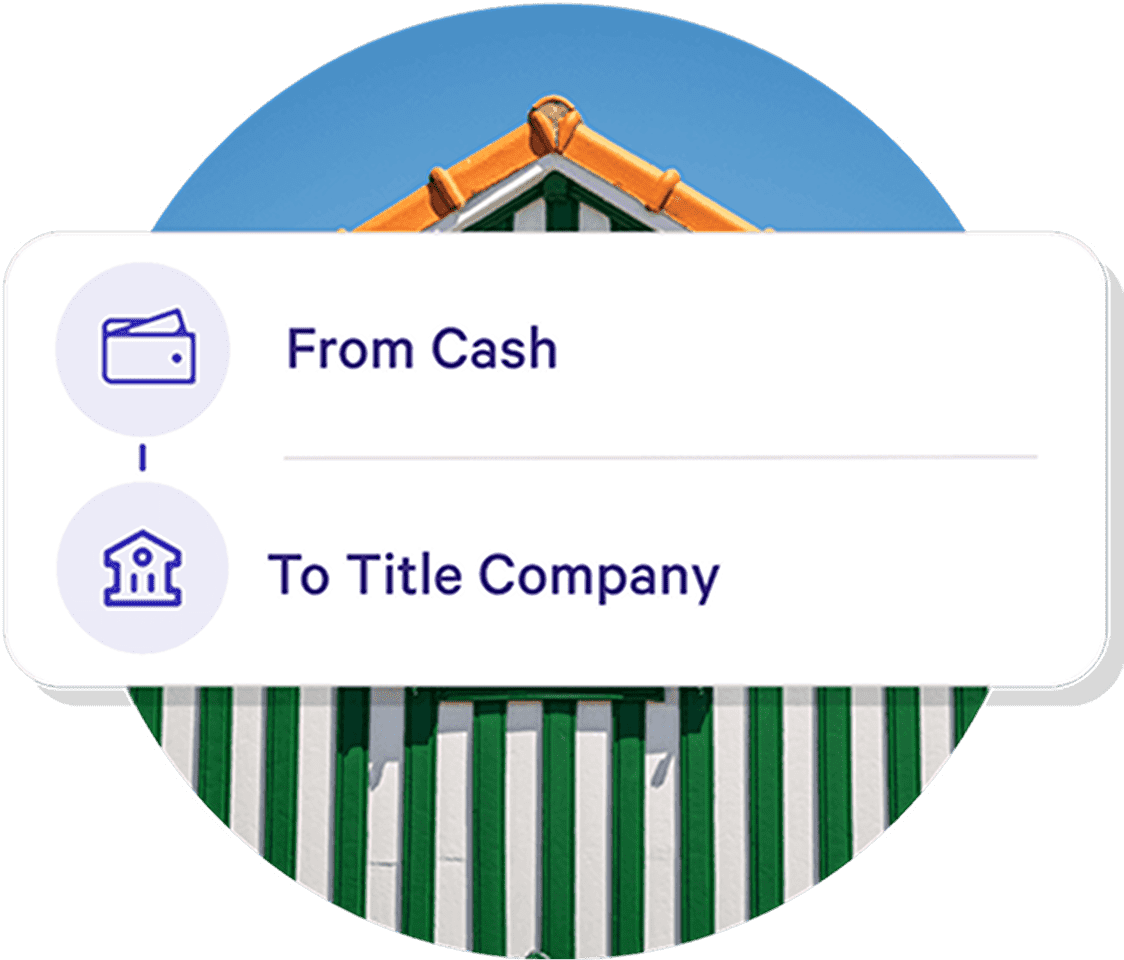

Free cash transfers

Transfer funds for free to title and escrow companies and accounts you own at other institutions.

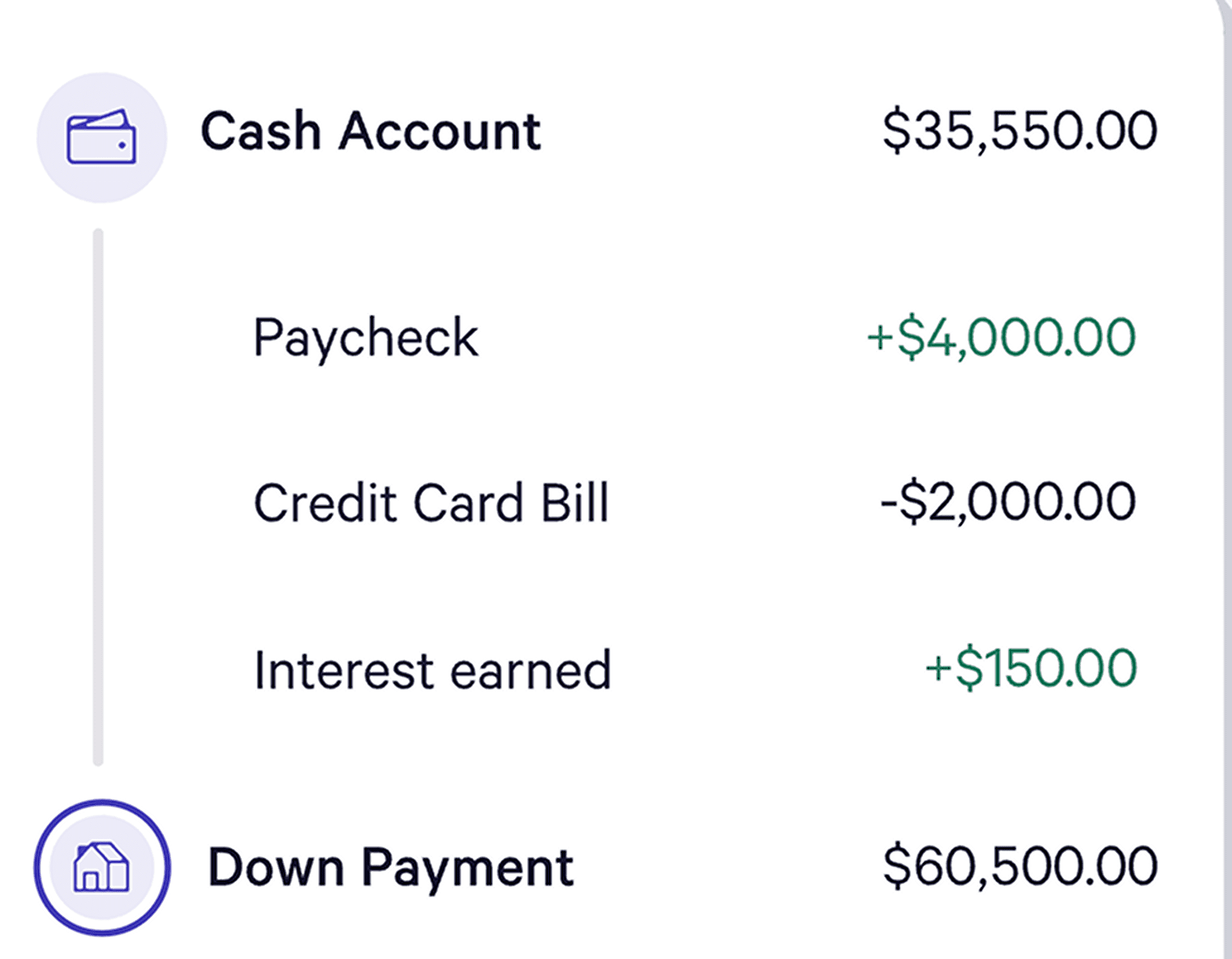

Pay bills, send and deposit checks

Move money and pay bills with account and routing numbers, plus send free checks and make deposits with our mobile app.

Saving features

Transfer to invest in minutes

Move cash to trading account automatically in minutes, and get your long- term money working even harder, ASAP.

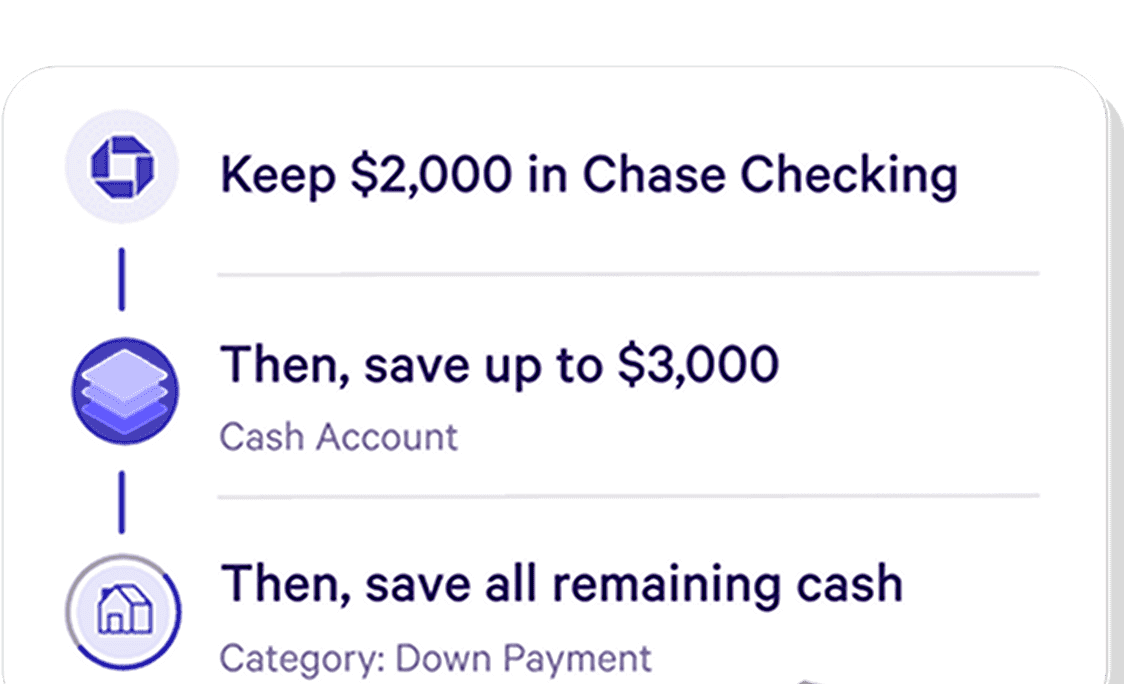

Automated savings and transfers

Create your own automated plans and set recurring transfers to move money to your savings goals and investments with Itrust Investment.

Cash Categories

Easily bucket your money to stay organized and set customizable saving goals.

Ready to get your money earning?

Open an Account Don’t just grow your savings.

Grow your spendings too.

Why pay for expenses out of a low-APY account if you don’t absolutely have to? With multiple ways to cover everything from credit card bills to aikido classes, you’ll keep earning 4.50% APY until your money’s out the door — without even breaking a sweat.

Money for monthly expenses: $15,000

You could earn an extra +$322.12in monthly interest.

Calculation is an estimate and assumes 4.50% APY for 30 days and no withdrawals. Actual interest payments and APY can vary.

Don’t save your

questions.

We’ve got answers.

1. Is 4.25% APY a promotional rate? Will it change on me?

Short answer: No, it’s not a promotional rate. And yes, it is subject to change.

Long answer: The APY you see on this page is the rate our own employees receive. We’ll always notify you when the Cash Account rate changes — which generally happens in response to a change in the Federal Funds Rate, or when there’s a significant change in the rates our partner banks pay us to hold our clients’ deposits.

2. When do I collect that sweet, sweet interest?

Your interest accrues daily based on your current balance, and pays out near the beginning of each month.

3. But what if I want to withdraw my money?

It’s your money, so you can withdraw it whenever you want, with no fees. If your external account is in the RTP® Network or is a FedNow® Service Participant, it’s eligible for free same-day transfers when you request as late as 6pm PT / 9pm ET every day, even on weekends and holidays!

For other accounts, withdrawals usually take only one business day to arrive — although if it’s from a recent deposit, it may take a few extra days to process.

Crypto Withdrawals take less than an hour and up to 24 hours depending on network congestion.

4. How hard is it to transfer from savings to investing?

So not hard at all! Money can usually be transferred to your Cash Account in minutes, and can also be invested in minutes when the market’s open.

5. Is my money safe with Itrust Investment?

Exceptionally safe. Your money gets up to $8 million in FDIC insurance (or $16 million for joint accounts). This is possible because we aren’t a bank — we sweep your deposits to up 32 partner banks (each with its own federally-insured $250,000 limit) at any given time. As a result, you get

32x the FDIC insurance in a Itrust Cash Account than you’d get with a regular bank account.Beyond the federal backstop provided by the FDIC, we keep your money secure by complying with the rules of our federal regulators, protecting your data with robust security practices , and conducting annual third-party accounting audits.

6. How many fees are there?

None! Zilch! Nada! We’ve never charged any account fees for the Cash Account, and we never will.